+86 183 6377 3366

+86 183 6377 3366 0102030405

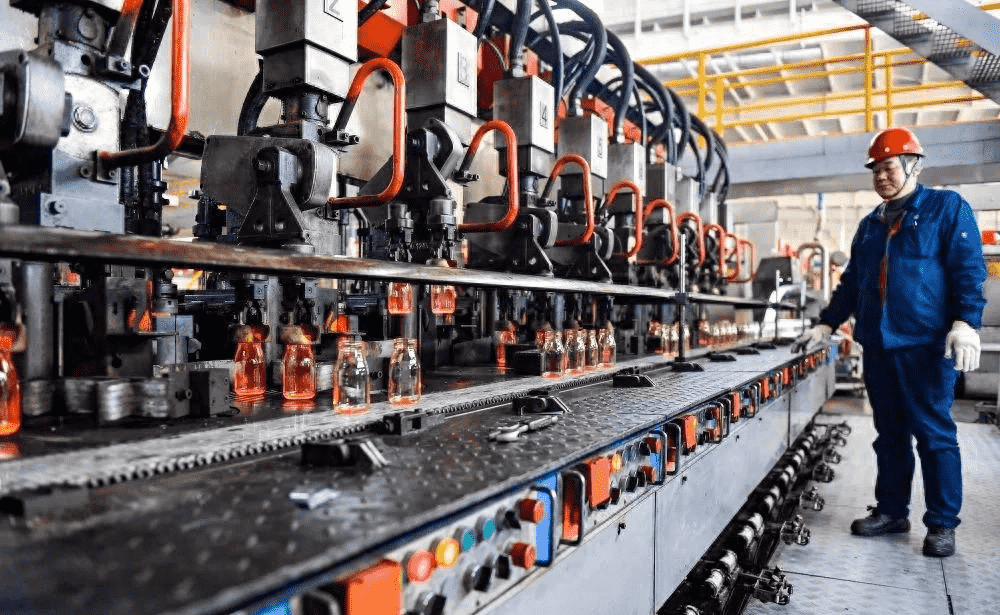

Tech Breakthroughs & Policy Synergy: Glass Industry Enters "High-End Replacement" Boom in 2025

2025-11-14

Policy Anchors Transformation Direction: Precise Efforts from "Capacity Control" to "High-End Promotion"

On September 24, six ministries including the Ministry of Industry and Information Technology issued the "Work Plan for Stabilizing Growth of the Building Materials Industry (2025-2026)", placing "strict control of flat Glass capacity" at the top, and clarifying the rigid requirements of strictly prohibiting new capacity and promoting the withdrawal of inefficient capacity. This policy directly targets the chronic problem of "increased production without increased revenue" in the industry - in the first half of 2025, 73 listed building materials enterprises achieved a net profit of only 11.8 billion yuan, and many leading enterprises fell into losses.

In sharp contrast to the strict control of low-end capacity, the policy's support orientation for high-end fields is clear: the "Plan" clearly lists advanced inorganic non-metallic materials as key development areas, and proposes a target of green building materials operating income exceeding 300 billion yuan by 2026. In the glass field, high-end categories such as photovoltaic glass, display glass, and smart dimmable glass have been included in the policy support list, and various regions have introduced supporting measures such as R&D subsidies and procurement preferences. Zhongtai Securities analysis pointed out that through the two-way regulation of "suppressing low-end and protecting high-end", the policy is accelerating the value reconstruction of the glass industry.

Technological Breakthroughs Reshape the Pattern: Two Hardcore Innovations Break Global Monopoly

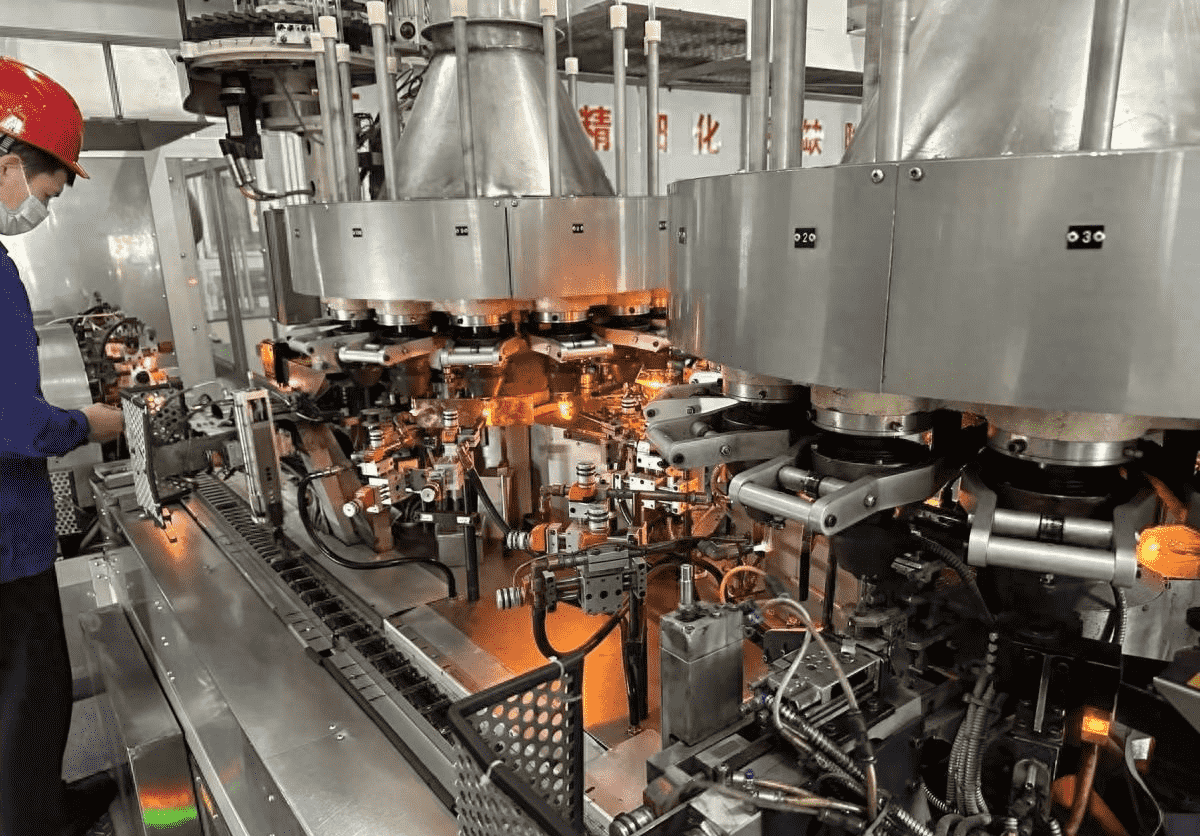

Display Glass: 8.6th-Generation OLED Substrate Achieves "From Follower to Leader"

On October 20, People's Daily disclosed a major achievement: the research institute under China National Building Material Group successfully developed the world's first 8.6th-generation OLED ultra-thin float glass substrate, which rolled off the production line in Bengbu, Anhui Province. This breakthrough broke the long-term monopoly of foreign manufacturers on high-generation display glass, making China one of the few countries in the world capable of producing OLED glass substrates above the 8.5th generation.

The difficulty of overcoming this technology can be described as "micron-level embroidery" - it is necessary to eliminate defects below 10 microns on a glass panel of nearly 6 square meters, which is equivalent to removing impurities the size of rapeseed on a standard football field. After 5 years of technological research, the R&D team not only achieved a breakthrough in size, but also reached the international leading level in core indicators such as light transmittance and flatness, with production costs 40% lower than imported products. At present, the product has entered the verification process of Domestic leading panel enterprises, and is expected to achieve mass production in 2026 with an annual capacity of 30 million pieces.

Smart Glass: Black SPD Technology Opens Up 100 Billion-Level Market

In the international market, new developments have also emerged in the field of smart glass. At the 2025 CES exhibition, Gauzy, a global leader in light control technology, launched its first black suspended particle device (SPD) smart glass, specifically designed for three high-growth markets: automotive, aerospace and architecture. Different from traditional transparent dimmable glass, this new product can present a pure black appearance, block more than 99% of visible light in the fully shaded state, and has the advantages of fast dimming (second-level switching between transparent and opaque), energy saving and temperature control.

It is estimated that the SPD smart glass market is expanding at a compound annual growth rate of 9.9%, and is expected to reach $13.4 billion by 2031. The launch of this black SPD product accurately meets the segmented needs of high-end car cockpit privacy protection, aircraft porthole lightweight, high-end building curtain wall design and other fields. At present, enterprises such as BMW and Airbus have expressed cooperation intentions, and domestic enterprises are also accelerating their follow-up, which is expected to achieve localized replacement in the field of building energy conservation.

Market Opportunities: Three Tracks Become Growth Engines

1. Localization of Display Panel Supply Chain

With the approaching mass production of 8.6th-generation OLED glass substrates, the domestic display industry chain will form a complete closed loop of "glass substrate - panel - terminal". Institutions predict that only the domestic OLED TV and smartphone market will need more than 50 million high-generation glass substrates every year, and localization replacement will bring a market space of more than 20 billion yuan.

2. Smart Cars and Green Buildings

The application of black SPD smart glass in the automotive field will significantly improve electric vehicle battery life (reducing air conditioning energy consumption) and cockpit comfort, and the penetration rate is expected to reach 15% in 2026; in the construction field, combined with the domestic green building materials going to the countryside policy, the application proportion of smart dimmable glass in new residential buildings is expected to increase from the current 3% to 12%.

3. Technology Export and International Cooperation

China's technological advantages in photovoltaic glass, display glass and other fields have formed export competitiveness. In the first half of 2025, the export volume of domestic energy-saving glass increased by 32% year-on-year, with emerging markets such as Southeast Asia and the Middle East becoming the main growth drivers. The 8.6th-generation OLED substrate technology is more expected to realize a high-end output model of "technology authorization + equipment export".